Automation in Finance and Accounting? 5 Best Use Cases

Published 12-05-2022 by KuFlow

Credits: RawPixel

Manual data processing, especially that involving numbers, has a high chance of human error. But the process is not just time-consuming, but it is very expensive as well. The solution to this problem is business process automation.

Technology is evolving quickly and can handle data in a more efficient and cost-saving way compared to human labor. That is the reason why around 80% of finance leaders have implemented or are planning to implement robotics in their business processes.

Indeed, according to the World Economic Forum, data entry jobs have suffered a decrease of almost 40% in the last ten years. Hence accounting, bookkeeping and payroll clerks are among the positions that are expected to diminish in the next few years.

However, hyper-automation is not necessarily related to layoffs. Actually, business process automation and digital transformation can reduce the burden of bureaucratic paperwork or email overflow with streamlined tasks that bring out only the best in each employee. With automation tools such as KuFlow, you can relieve staff to deliver extra service to your top-level customers.

Use Cases in Finance

Let us explore some of the best use cases in finance that surely will be worth the investment your company can make

Invoice Processing

Invoice Processing is a repetitive and tedious task, especially when a lot of different business rules, prices and discounts must be taken into consideration.

Every customer-centric organization struggles to create correct invoices in the client-required formats on a timely basis. Automation can assume the tedious repetitive task while ensuring that all the business requirements are met, including dates, format, approval conditions and other requirements.

Payments Processing

All organizations are often heavily involved in cash inflows and outflows. The repetitive tasks of creating payments and sending confirmations to vendors, as long as getting approval from department managers can be so monotonous as overwhelming.

Processing payments will eliminate the possibility of human error, but it will also relieve staff to take more valued tasks. An automated system can handle all the tasks required for creating and sending payments, preparing a summary of the transactions as drafts, so your company doesn’t lose flexibility and human supervision in case of need.

Purchase Order Processing

Financial departments usually assume procurement in companies because there are several factors to consider, such as cash flow situation and vendor agreements. Sometimes this can deliver into complex procedures, with several steps, needs for approvals, and business conditions.

Automating the purchase order processing can bring agility to the process while providing transparency of each transaction at the same time. Business users can check each procurement need by monitoring the purchase orders, that have been created automatically according to the needs reported by other departments and the business rules put into consideration.

Budget Planning & Forecasting

Fetching details with the help of automated tasks from various reports and systems will help create the forecasting report with accuracy. Thanks to automation, new reports can be prepared based on historical data and current information, giving support to decision-makers. Comparison and trends can be drawn without manual intervention, avoiding human errors during the preparation.

Bank Reconciliation

In times of uncertainty, companies have a bigger need to check frequently their cash position. A significant number of working hours are required in order to ensure the balance comparisons and accounting are accurate. Logins into different systems are also required to gather information for this task, making this process tedious, error-prone and repetitive.

Implementing automation tools like RPA can bring relief to the accounting department because reconciliations are made automatically with minimal human intervention (usually only needed when data reflects misalignments).

Summary

Repeated and monotonous tasks keep the employees disengaged and condemned to perform low-level jobs which provide little value. Workflow bottlenecks and possible human errors hamper productivity and reduce competitiveness.

Automating the business processes, finding the most repetitive tasks and implementing them with tools such as KuFlow can bring fresh air to the department. This will not only provide more agility to the business but also will bring the opportunity to give employees a more significant task in the company.

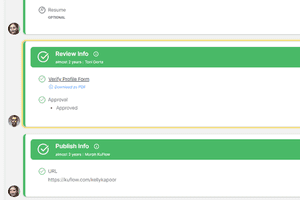

KuFlow is a workflow engine based on the “Workflow as Code” paradigm. We provide automation solutions that can automate your business processes seamlessly, leading to a reduction in manual processes and empowering teams.

Try KuFlow for free, create your own free account and start automating your company.